‘First published on IAM’

Patent examination by the Indian Patent Office (IPO) has slowed down dramatically over the last few years, threatening to impede the country’s efforts to become a global innovation and intellectual property protection hub.

While patent filings in India have exploded in volume, a “near standstill” in patent examination between 2024 and 2025 suggests the agency has not been able to keep up. This is primarily owing to a lack of skilled examiners and other administrative issues, local lawyers say.

And, while there may be budding signs of improvements to the situation, patent pendency has been hit, and IP firms are feeling the pinch.

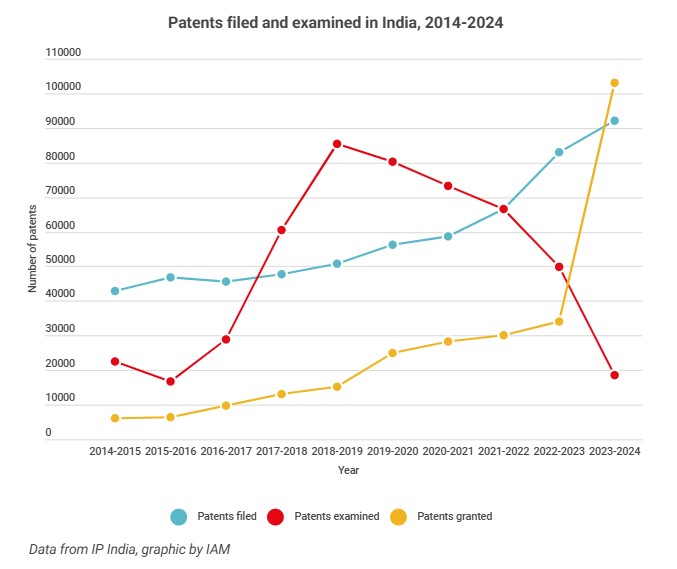

Data from the IPO’s Annual Reports shows a sharp decline in the number of patents examined since FY 2019-2020, contrasting with the steady increase of patent applications and grants over the past decade.

A whopping 85,000 patents were examined between 2018 and 2019. Since then, however, examination numbers have plummeted, falling to just over 18,000 in 2023-2024, a year that otherwise proved to be impressive for the patent office. That year, filings exceeded 92,000, and grants leapt over the 100,000 mark.

But lower examination numbers now may lead to fewer grants in the coming years, one lawyer comments. In FY 2024-2025, only around 9,600 patents have been examined, firm Casimir Jones reports.

These numbers alone paint a bleak picture for patent examination. But law firms whose bread and butter is patent prosecution are specifically concerned about a decline in the IPO’s issuance of First Examination Reports (FER) between 2024 and 2025. The FER is a document the patent office gives an applicant after a patent has been examined – it contains requirements that the applicant must meet before a patent can be granted.

The Annual Report does not provide data on FER issuances (patent examination figures are not strictly equivalent to the number of FERs issued), but data compiled by Anand and Anand helps to illustrate the issue.

The data, published in a LinkedIn post, says that the IPO issued 13,777 FERs in 2024, down 42% from 24,027 FERs issued in 2023.

This slowdown at the IPO has had two main effects, according to lawyers IAM spoke to for this story. The first is that administrative uncertainties have affected the strategies of patent applicants. “With fewer examination reports being issued, the volume of responses and hearings has declined, delaying the overall prosecution strategy for many of our clients,” Archana Singh, partner at Singh & Singh, tells IAM.

“For example, in recent months, multiple cases were expected to be picked up for examination by the IPO where we are still awaiting examination reports and the lack of certainty in timelines has resulted in a major concern among the clients and stakeholders,” Singh adds.

Before the examination slowdown, the patent grant timeline in India stood at about three years, but a patent could be granted within a year under expedited examination, Manisha Singh and Virender Singh from LexOrbis reported last year.

This was a massive improvement from the patent pendency period of seven to eight years a decade ago, no doubt a result of the efforts of the IPO to clear its backlog. However, the current disruption may add at least two to three years to the prosecution timeline for patents in certain technology areas, says Vaishali R Mittal, a senior partner at Anand and Anand.

Secondly, with less work coming in from the patent office, some law firms assisting applicants have begun to feel the strain.

Reviewing and responding to FERs – and then later attending hearings before the controller or examiner – keep prosecution lawyers busy, explains Madhusudan ST, partner at K&S Partners, adding that “our billings are directly dependent on the rate and frequency at which the patent office issues FERs”. Firms with more diversified practices can better handle lean periods in prosecution work, but smaller firms may not be as equipped, he comments.

Indeed, the gravity of the situation has compelled the legal sector to come together and bring their concerns to the IPO. Singh says multiple discussions between the patent office and stakeholders have taken place and that the dialogue is continuing. Moreover, members of the International Association for the Protection of the Intellectual Property and of the Asian Patent Attorneys Association submitted a joint representation to the IPO and its overseeing body, the Department for Promotion of Industry and Internal Trade, says Anand and Anand’s Mittal.

Mittal says the industry’s main concerns include the inconsistent sequencing of examinations (older applications are pending, while newer ones have already been granted), “unjustified” objections on the General Power of Attorney and stamp duty (features unique to Indian patent prosecution), post-hearing delays, and lapses in communication, such as non-receipt of FERs, hearing notices and refusal orders.

“The abrupt shift from a high-volume grant phase in 2023-2024 to a near standstill in 2024-2025 with no prior communication has had a disproportionate impact on startups, MSMEs, academic institutions, and IP firms,” says Mittal.

And, more broadly, this “unpredictability” may also harm international confidence in India’s IP regime, Mittal comments.

In recent years, the Indian government has taken steps to transform India into a key global player in technology and IP. For one, the IPO has worked to accelerate patent examination, shaving years off the application process. Furthermore, India has become an attractive venue for patent enforcement, particularly in the realm of SEPs, with the Delhi High Court issuing several decisions largely favouring patentees over implementers in high-profile FRAND-related cases.

And, most recently, the government formalised its interest in establishing a sovereign patent fund for telecom technologies and unveiled initiatives to support domestic R&D and IP rights acquisition, particularly in the field of 6G.

Clearly, India has had no shortage of ambition to become a technology and IP powerhouse in addition to being a manufacturing mammoth. But, Singh says, “if the current situation is not dealt with in a timely manner, we will end up losing the momentum”.

The IPO has hired new examiners and confirmed that the examination backlog will be cleared soon, says Singh. But it appears the patent office has more matters to tackle beyond staffing issues: Casimir Jones shareholder and IP attorney Lisa Mueller writes that the government “must address operational inefficiencies, enforce fair and predictable procedures and implement robust communication protocols”.

K&S Partners’ Madhusudan ST adds that his firm has observed an increase in FERs issued by the patent office since May. “There is a hope that the situation may return to normalcy by end of this year,” he says.

The IPO – formally known as the Office of the Controller General of Patents, Designs and Trademarks – did not respond to IAM’s request for comment.

etc. whilst wrongfully claiming to be part of our firm and making false claims and allegations.

etc. whilst wrongfully claiming to be part of our firm and making false claims and allegations.