‘First published on Lexology’

By: Safir Anand and Abhishek Paliwal

Effective from April 1st, 2025, all companies seeking to file draft offer documents and offer documents with the Securities and Exchange Board of India (“SEBI”) will be required to disclose Key Performance Indicators (KPIs) in accordance with industry standards established by the Industry Standards Forum (“ISF”). The ISF comprises representatives from three prominent industry associations-FICCI, CII, and ASSOCHAM-along with the stock exchanges (“NSE and BSE”) and in consultation with SEBI.

Objective

The primary objective of these standards is to standardize the disclosures made by companies filing their listing documents with SEBI. This ensures that investors, particularly those considering applications for equity shares of a company, can make well-informed decisions based on consistent, transparent, and comparable data.

Scope of KPIs

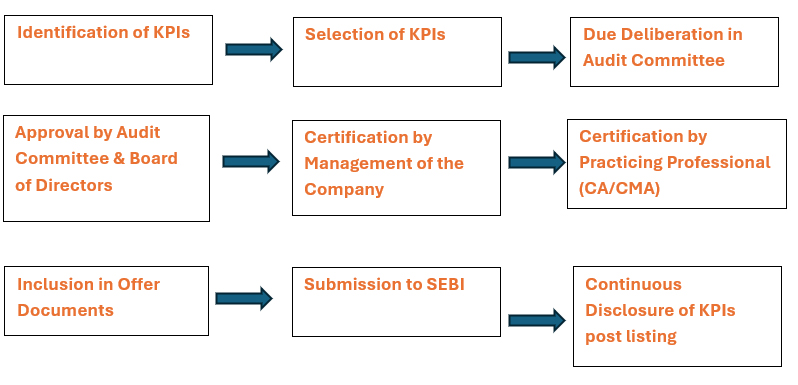

The disclosures related to KPIs will encompass definitions, classifications, selection procedures, certification processes, and other relevant details. A key emphasis is placed on thorough discussions of the selected KPIs during Audit Committee meetings before these disclosures are included in the offer documents. The KPIs must also receive formal approval from the Audit Committee.

The disclosures will include, among other things, an explanation of how the share value has been determined, clarifying the basis for the chosen valuation. Companies will also be required to disclose operational information, basis of future growth prospects, associated risks, and any information shared by peer companies that does not compromise business confidentiality. Notably, promoters who have raised capital from private investors prior to the Initial Public Offering (IPO) must disclose all relevant information shared with pre-IPO investors.

These disclosure requirements are particularly pertinent for startup companies that often raise funds from Private Equity firms, Venture Capitalists, Angel Investors, and other private sources. As such, these standards will help provide transparency and ensure that new or retail investors have access to essential information to make informed investment decisions.

Certification of KPIs

The new standards require certification of Key Performance Indicators (KPIs) by the Managing Director (MD), Executive Director, Chief Executive Officer (CEO), Chief Financial Officer (CFO), or Manager on behalf of the company’s management. This certification applies specifically to KPIs, including the “Basis of the Issue Price.” In addition, the selected KPIs must be validated by a practicing professional, such as a statutory auditor, Chartered Accountant, or a firm of Chartered Accountants holding a valid certificate issued by the Peer Review Board of the Institute of Chartered Accountants of India (ICAI). Alternatively, Cost Accountants with a valid certificate issued by the Peer Review Board of the Institute of Cost Accountants of India (ICAI) may also validate the KPIs.

Continuous Disclosure Requirements of KPIs

The standards also mandate that companies provide continuous disclosure of KPIs from the offer document. These disclosures must be made at least annually, or more frequently if determined by the company. The disclosure must continue for at least one year after the listing date or until the issue proceeds are fully utilized, whichever is later. This aligns with the “objects of the issue” section of the prospectus, ensuring that investors have up-to-date information regarding the use and progress of the funds raised through the offering.

Flow of KPI

etc. whilst wrongfully claiming to be part of our firm and making false claims and allegations.

etc. whilst wrongfully claiming to be part of our firm and making false claims and allegations.